by Victor C.

Transactions online have taken a new toll, as payment on delivery is getting outdated and replaced by the use of cards, either debit or credit for payment. Payment online then becomes the new order until drawback was noticed of how card details used for transactions can be harvested, making it riskier to transact online unless one wants to stand the risk of losing more than was planned to be spent. But with evolution and inventions of ways to manage the drawbacks of every previous invention, a virtual credit card became a new order.

Contents

A virtual credit card is more like a temporary card that can be used one-time for transactions online. It is more like a disposable card, which loses its value right after the one-time usage. This will secure the user from the risk of a data breach because, in any case of a data breach, the harvested card details will have been invalid. This is just a means of adding another level of security for every credit card user, and also reduces the fear of engaging online transactions.

Most often than not, virtual credit cards are designed for one-time usage but can be used more than once on some occasion, which might depend on request or the service providers' discretion. But what seems to be the drawback of virtual credit cards is in such cases as refund and verification. Receiving a refund, in any case, might be very difficult since the virtual credit card would have expired, and the user might be forced to take the stores' gift card against the will. In case of verification, for example, upon request of the credit card, the payment was made within any case of physical verification.

1. It is completely secured, and its use can be blocked in case of uncertainty of fraud

2. 100% digital and does not require carrying a card about

3. They usually have short expiry dates, and updating the card number will be required every time it expires.

4. It secures the main account from fraud and security breaches.

5. It allows setting spending limits with some specific merchants.

Most merchants do this to escape the liability of responsibility for security breaches. Though it is much more recommended, some merchants occasionally prohibit it.

Setting limits has not been so easy, but it becomes much easier with a virtual credit card. This will help control spending and keep a tab of the outflow of money on the main credit account. Though there are regulations regarding limits, depending on the card provider, so checking the company's regulations will be much needful.

Some times will arise to pay in another currency other than the credit account's main currency. To do that, most virtual credit card providers have a setting feature that allows you to set the current currency to use. For example, if the card has been a USD card, changing it to EUR is much easier, but the features depend on the Virtual Credit Card provider.

One of the outstanding reasons for using a virtual credit card is that it is 100% digital, this secures the user from card damage and theft as in the usage of a physical card. Virtual credit card, however, prevents access to the user's private information like the billing address, names, and even the social security number. This is made possible because all virtual credit cards needed to work are the set of randomized numbers that work as the credit card number and become invalid after the set time.

Staying safe in using a virtual credit card is very necessary, and for that to be achieved, there are various tips to take note. The United States Law mandated that proven identification must be provided for virtual credit cards in any case. To safely own and use a virtual credit card, thorough research must be done on the requirements, and the chosen service provider must be trusted. However, in using it, phishing must be avoided on the website browsers by ensuring that the website link is well spelled and the connection is verified and secure.

| Virtual Credit Card Provider | Outstanding features |

| 1. Payoneer | Receiving payment from mass payout companies as virtual credit card |

| 2. American Express Go | Mobile Application and the excellent reward system for usage |

| 3. Netspend | Identity verification as an extra layer of security and the avoidance of credit score for account opening. |

| 4. EntroPay | Free virtual credit card generator |

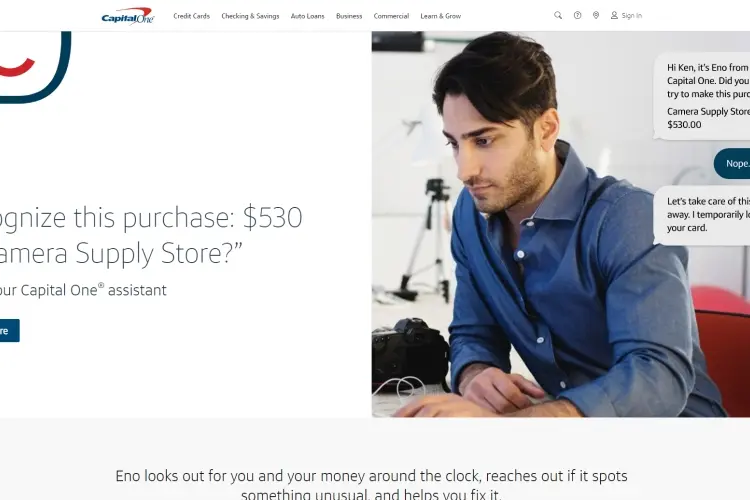

| 5. Capital One | Browser extension that make transactions easier and more secure |

| 6. Walmart Money Card | Fewer limitations and no commission whatsoever on usage. |

| 7. Freecharge Go Mastercard |

|

If these features ever sound cool and attractive, the virtual credit card providers will be listed, and the peculiarities will be discussed for the choice of the one to start using.

Payoneer is an amazing wallet that allows you to receive money from any country whatsoever or even from mass payout companies, and in such service, they had few rivals. However, they have a feature that allows you to withdraw money from the wallet to a virtual credit card or even get paid through some "eligible" mass payout companies. Though they have their own designed Debit Card, most e-commerce platforms still accept their virtual credit cards.

American Express is one of the popular and common banks that creates virtual credit cards without much stress. These cards can be used on different shopping websites and numerous online transaction platforms. A very amazing feature of American Express is that a physical version of the virtual credit card can be requested and can be received, which can be used for purchases in person. It also has a mobile application that controls the virtual card, and they have an excellent reward system for the usage of their credit card.

Netspend is one of the best virtual credit card providers because of the amazing features that come with it. It required no activation fee for use, and they did not have any minimum balance for using the card.

Another major reason this is one of the best is that, like other physical cards, it requires an identity verification, which serves as an extra layer of security in usage and getting one or even opens an account with Netspend. They do not check your credit score. The system of their Virtual Credit Card provision is free but only take commissions on every purchase made on the card.

EntroPay is another online financial institution with a "Free" system that generates a Virtual Credit Card. Being known as one of the largest credit card generators in the businesses, they rose to be trusted with the virtual credit card's advent. They offer diverse options of getting the card; either a prepaid virtual credit card or the card is linked with the credit account with the bank −and these two options have been proven effective.

Capital One has a dedicated channel for the creation of virtual credit cards called Eno. This virtual assistant comes in a browser extension in Microsoft Edge, Google Chrome, Mozilla Firefox, and helps cardholders quickly generate virtual cards while shopping for the one-time usage. It works in a way that Eno pops up during online shopping checkout and gives instructions on how to generate a virtual card for the transaction.

Walmart Money Card also is a service that offers free virtual credit cards and even does not cut any commission on transactions made on the card. They do not have too many limitations for service usage comparing to other service providers.

One of the drawbacks of the service is that it is only available in the United States, and the usage of their virtual card is only limited to the country.

But the take note of the fewer limitations and free usage is one of the best virtual credit card providers to patronize and use.

Freecharge Go is another amazing virtual credit card provider that allows you to pay with the application. Every platform, vendors, or e-commerce website where Mastercard is accepted accepts Freecharge Go virtual credit card, increasing its versatility and more options for spending online. This provider is concerned more about its users' security, and the virtual card has 128-bit encryption and is a PCI-DSS compliant, which makes it safer and more secure for use.

Every avid shopper online will find virtual credit card useful as it helps in cutting expenses based on the limit set on the card. Virtual cards' major emphasis is safety and security, as every user's personal information is secured from breaches. Everyone who cannot trust vendors and online shops with their credit card number now has virtual credit cards for every online transaction.

About Victor C.

Victor is a highly acclaimed sports writer known for his insightful analysis and captivating storytelling. Born and raised in a small town, he developed a deep passion for sports from an early age. He excelled in both academics and athletics throughout his school years, which laid the foundation for his future career.

|

|

|

|

Yo get FREE Gifts now. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|