by Victor C.

A prepaid plastic can act as a bank account replacement tool. Such prepaid cards provide ease with not many expenses. Cards that are prepaid are often difficult to get. There's typically not at all checking of credit, then they're frequently accessible regardless of whether you can't get a financial balance due to a terrible financial history. A few organizations likewise issue versatile mobile improved accounts don't require a clean banking history of a consumer - and they frequently cost exactly fewer compared to cards that are prepaid.

Contents

With such a significant number of credit and debit cards accessible nowadays and their various related advantages and rewards, finding the best-prepaid charge cards without any expenses may appear to be an overwhelming assignment. Be that as it may, we've limited the rundown to what we accept are probably the best choices available.

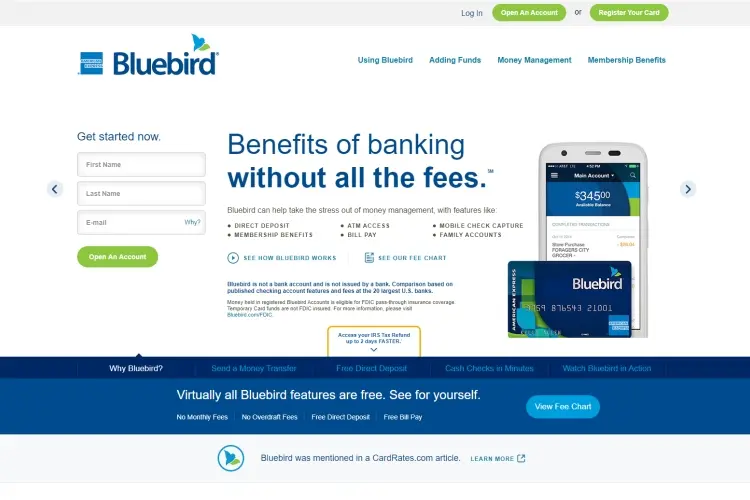

Bluebird debit card has issued by American Express and in association with Walmart, offers more than the normal prepaid charge card, and you can add money and can use the cash without paying any fees. In any case, Bluebird has limits with regards to vendor acknowledgment, and it doesn't permit money back at retailers. No monthly expenses and no fees for online activation or deactivation as well as you don't need to check credit.

Moreover, there are no ATM charges on the off chance that you utilize one of the more than 25,000 MoneyPass® ATM locations. In any case, maybe the best component of the BlueBird Card is the arrangement of individual accounts and cash that they offer with it. Utilizing the Insight® application allows you to arrange, track and set spending limits for up to four separate cards. You can likewise screen and deal with your record from anyplace. You'll gain boundless 1% money back reward each time you shop with your prepaid card. Your money rewards are added to your card directly after you win them, and you can reclaim awards whenever.

Contents

Many of the prepaid cards charge one on monthly basis or else after purchasing something, yet Movo Prepaid Card charges you neither. The exemption is on the off chance that you go over a quarter of a year without action; at that point, an amount of $4.95 dormancy expense is charged every month until there's certain kind of action. The card's "virtual" component lets you purchase things on the web, and there are ATM withdrawals, physical cards for individual buying, and Seller's money back. The Movo additionally has free ATM arrangements.

You can pay online bills freely with Movo. You can likewise make one-time auxiliary computer-generated cards called the "MovoCoins" with personal card details. They may secure your fundamental record number during exchanges. The Movo card can be utilized with Google pay, Samsung Pay and as well as Apple Pay for offering children stipends using MovoCoin.

To gather more information about its app, see below for more

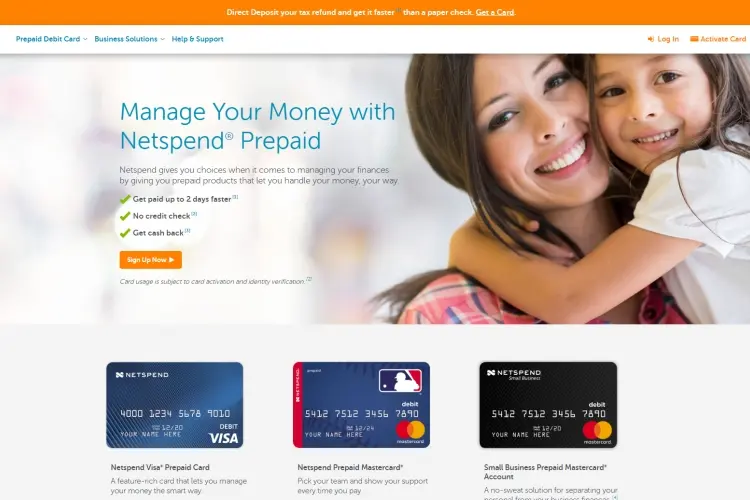

The Netspend Prepaid card permits you to get paid quicker with a direct deposit. You can stack cash onto your record utilizing mobile check deposit, reload at more than 130,000 areas, or get cash from loved ones who have Netspend cards. Download the free Mobile App to effectively deal with your Netspend account, earn cashback from eligible purchases, and get a reward added to your account when a friend of yours joins. You can pick between two plans that have fluctuating expense structures relying upon your deposits. The default plan of Netspend, which charges no month to month expense, yet $1.50 for every signature or PIN transactions. The Premier Fee Advantage Plan is the best when you have an immediate store of $500 or more. You'll pay $5 every month and transactions are involved in the plan.

It is extremely unlikely to stay away from a fee-you'll either pay the month to month expense or transaction expenses. What's more, keeping your card dynamic is vital to avoid the inactivation fees of about $5.95, which applies if the card isn't utilized for more than 90 days.

Check out the video of it

The Akimbo card permits up to five optional cards either for relatives or household categories, for example, gas or goods. Akimbo doesn't charge a month to month expense, yet it charges for the initial five PIN-based buys every month - that is the point at which you select "debit" at a store checkout and punch in your PIN - up to a month to month limit of $4.95.

Be that as it may, Akimbo doesn't have a network of an ATM, so any ATM use brings about a charge. It's less expensive than numerous prepaid check cards' out-of-arrange ATM charges. It is also very easy to disable and enable cards whenever from within the application, as well as get text updates.If your account is inactive for more than 12 months, you have to pay an amount of $5.95 inactivation fee at the start of the 13th month. Watch below for more:

FamZoo is a friendly debit card that lets guardians become virtual bankers for their children, even those younger than 13 years. Four cards can be used as a part of their monthly plan, yet more can be included for a one-time $2 expense per card. You can move cash among cards and make programmed transfers between the cards. From the website or application, you can send allowances, split installments, check balance and all the activities over all the cards and set up content and email updates. There's likewise free access to the MoneyPass system of more than 32,000 ATMs across the nation. At the point when you use an ATM without the MoneyPass logo, you might be charged an amount from the ATM administrator; however, FamZoo doesn't charge its own expense. A paid FamZoo membership permits you to request and utilize something like four FamZoo prepaid cards as long as your membership is dynamic. You can arrange extra cards for a one-time charge of $2 each. Here's the commercial promotion video of it.

Greenlight stands apart for a feature that other prepaid cards need: store-explicit spending controls. Guardians can preapprove what stores their children go through cash at, so $300 reserved for school supplies must be spent at a school book shop, for instance. The prepaid card likewise offers real-time activity alarms, free card-to-card moves for allowances and remotely securing cards in case they're lost. A Greenlight record can have up to five subaccounts, so it works for a family. See the below details to understand more of the promotions

Wells Fargo's prepaid charge card exploits free reloads of money and checks through the bank's enormous system of more than 13,000 ATMs and around 5,500 branches in 36 states. Some banks offer access to greater ATM systems, however, Wells Fargo's system has an edge by permitting its clients to reload, or store, money, and checks. Live client care is accessible by telephone all day, every day. The $5 month to month expense; no expense to initiate card, no deactivation fee however a "delicate" credit review is required. To understand how it works, check out this video tutorial

The Brink's Prepaid Mastercard charges no late expenses or premium accuses and offers the PayBack Rewards program, which empowers cardholders to gain money back on numerous regular purchases. By utilizing the Brink's card for purchases instead of your bank debit card, you could collect hundreds - or even thousands - in real money back rewards. Brink's MasterCard gives you the genuine feelings of serenity you deserve. Making sure about money and assets since 1859. With Brink's Direct Deposit, you can get paid quicker than a paper check. No late expenses or intrigue charges since this isn't a simple credit card. Utilize the Brink's Money Prepaid Mobile App to deal with your Card Account in a hurry and enlist to get an instant message or email alarms (Message and information rates may apply.) Here is the video for more details

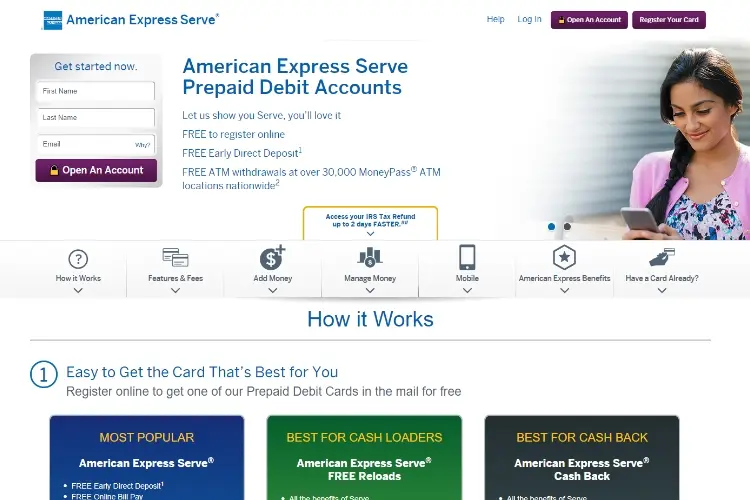

The American Express Serve Card is one of the main prepaid cards that offer boundless 1% money back on each dollar you spend shopping in stores or on the website. It charges a month to month expense of $5.95 and up to $3.95 for refills, however, this might be certainly justified regardless of the expense on the off chance that you utilize your card as often as possible. Likewise, there are no ATM charges when you use MoneyPass ATMs, and online bill paying is additionally free. Truth be told, there are not very many extra expenses with the Amex Serve card, making it an incredible go-to card for dynamic clients. Cask back money is available as soon as you won them. For an overview, take a look at the below video

And with that, it's the end of our list. There are other debit cards available; we tried to gather the best ones for you. Feel free to check the links above. Make a smart choice!

About Victor C.

Victor is a highly acclaimed sports writer known for his insightful analysis and captivating storytelling. Born and raised in a small town, he developed a deep passion for sports from an early age. He excelled in both academics and athletics throughout his school years, which laid the foundation for his future career.

|

|

|

|

Yo get FREE Gifts now. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|