by Victor C.

Students can be confused people when it comes to some issues in life as they are just in the learning phase. If you are a student beginning your high school, you might be concerned about your high school expenses, and we would like to help you with managing money. So, you don't have to worry as we have found the best student accounts to help you manage your finances in a better way.

Haven't heard of a student account? That might be because you never needed one. But, now you should know about the student bank accounts with excellent benefits to make sure you don't miss any of them and save some money too!

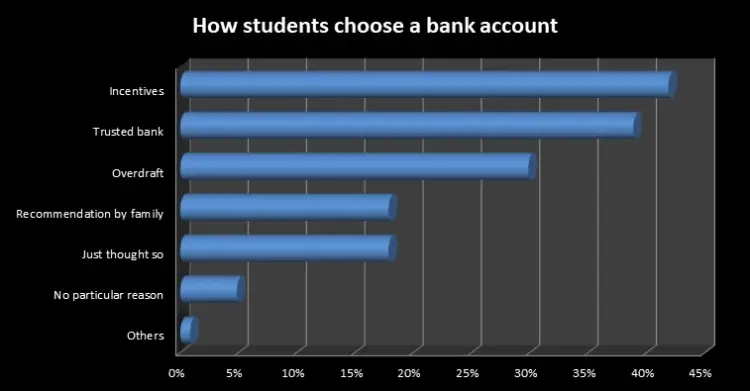

You might be wondering that there are already so many bank account options to choose from, so why is there a need for student back accounts? Student bank accounts have all the advantages of a simple checking or savings account with additional benefits. The most prominent features of student bank accounts include interest-free overdrafts, reduced fees, free ATMs etc.

No, we won't leave you to find out about the fantastic benefits offered for the students on your own. Let's tell you some of the best interests of a student bank account that are likely less to be found in regular checking or savings accounts.

Free banking refers to the exemption of different kinds of banking fees. However, not all banks offer free banking, but most of them have reduced prices for students .

The student banking accounts also provide a debit card to the account holders. It is reasonably helpful in emergencies when you do not have cash on hand. However, you need enough money in your account to withdraw cash from any ATM.

Some banks also give the service of a credit card to the student account users as a form of collateral. But, it is advised not to have a credit card as it can leave you in debts that can cause trouble for you.

Interest-free overdrafts are among the key features of accounts particularly designed for students. Banks are aware of the fact that students are short on cash, and that is why they offer overdrafts that are interest-free up to a specific limit. The limit of money for the interest-free overdrafts increases over the years to accommodate the monetary needs of students.

It might be news to you, but some banks also give additional investment options, gifts, discounts etc. on the student bank accounts to facilitate the students owing to their needs. An important thing to note is that these advantages are long term and provide a good time facility to the students.

Opening a student account is quite simple, and you get the approval readily if you provide the necessary documents to the bank correctly. Let's tell you what you need to open a bank account.

· Proof of student status: The bank needs to be sure that you are a student to avail of the student account merits. You can show an acceptance letter from the university or UCAS letter offer.

· Photo ID: Some banks might ask for one proof, and others ask for two proofs like your driver's license or passport.

· Address proof: A recent utility bill can be used as proof of your residential address.

The documents should be original in order to get an account in the bank. You can also apply online for a student account as several banks have this facility now.

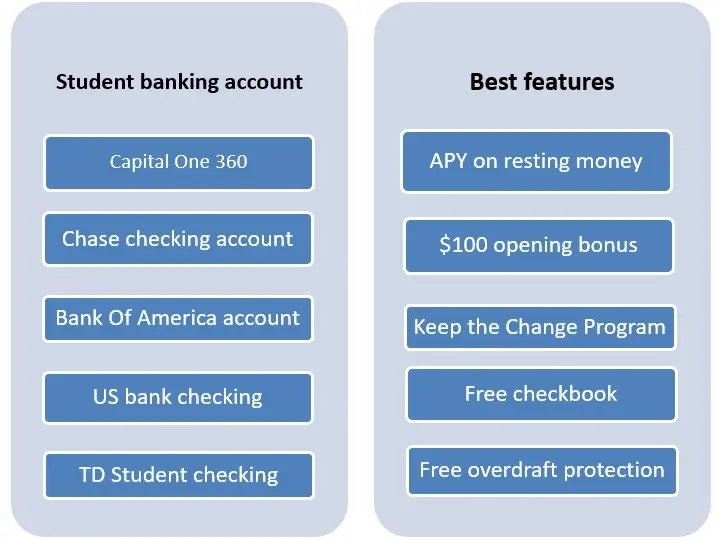

Best student bank accounts 2023

As you know the necessity of student accounts, you might not be aware of the best accounts and their offers. There's a list of the best student accounts we have sorted out for you to have a look and decide for yourself.

Capital one is highly popular among people for its checking and saving accounts. So, Capital One introduced its student account by the name MONEY . It lets students manage their money and also gives them a little interest on the money as an extra. The Capital One 360 MONEY account has no annual fees or minimum opening balance conditions. Without any fees or charges, this bank account gives you a lot of merits like debit cards, online banking facilities , mobile check deposits, text alerts, etc. You not only get a free debit card, but you can also access over 39,000 ATMs without any foreign transaction fees.

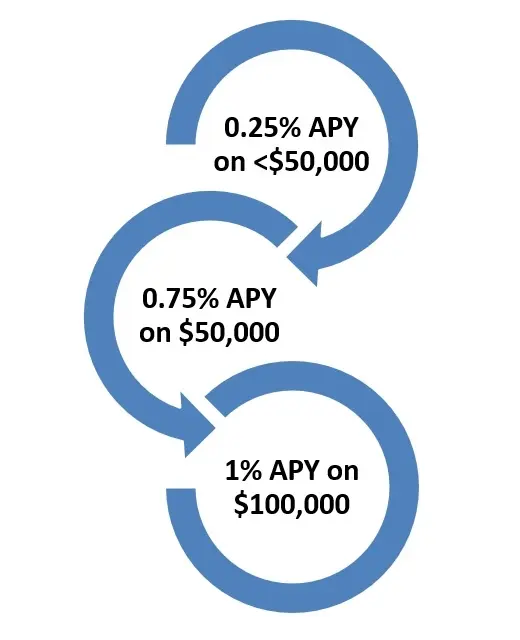

Another prominent feature of this account is that it gives up to 1% interest on your money. It gives a 1% APY on $100,000, 0.75% APY on $50,000 and 0.25% on amounts less than $50,000. It might be less for you, but it is still better than not getting any interest on your money.

Standouts of Capital One

· No annual fees

· No minimum balance limit

· Free debit card

· Access to over 39,000 ATMs nationwide

· APY on your resting money

Few considerations

· You have to be above 18 years of age to get the card

· Parents have access to all account features aside from the ATM card

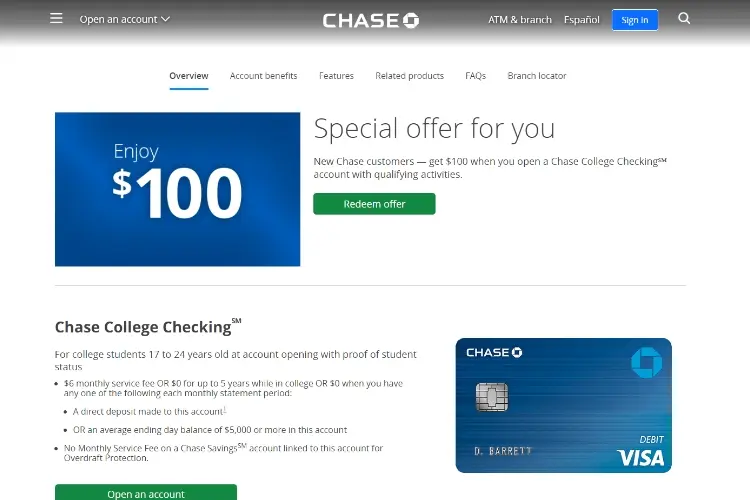

Chase Checking Account can be among the most favorable options for students as it gives two options depending on the age bracket you fall in. Chase has two student account options to choose from.

Chase High School checking account is for students between 13 to 17 years of age that can be opened with a parent or guardian. Chase charges a $6 monthly fee, but you can avoid it by keeping at least $5,000 in the account as the average ending day balance or make a monthly direct deposit. Also, the account asks for $25 as a minimum opening balance.

Chase College checking account is for students between the ages of 17 to 24 . The benefits of having a college checking account are higher than that of high school as the monthly fee gets waived off for 5 years of college. However, you would have to prove your college status to get this benefit by providing an acceptance letter or your student ID. After your graduation date , you would have to maintain a minimum of $5,000 in the account to avail of the fee exemption further.

Chase offers free ATM transactions at more than 16,000 ATMs across the country. But there is a transaction fee of $2.50 on withdrawing money from non-Chase ATMs and $5 on international withdrawals.

Standouts of Chase checking account

· $100 bonus on account opening

· No monthly fees for college years Chase

· Quick Pay to send money to any bank account

· Free transactions at 16,000 ATMs

· Over 5,000 branches for convenience

The student account by the Bank of America can be the right bank account for you if you are beginning to save money . You have to be enrolled as a full-time student and be under 24 years to qualify for the student account. If you are thinking of the advantages you can avail as a student, the foremost is the exemption from the monthly fees. Also, it has a student-specific Keep the Change savings program that rounds off your purchases through the ATM card to the nearest dollar and transfers the extra money to your account. Isn't it perfect for saving some bucks?

Moreover, the Bank of America gives two account options to select from.

· Advantage SafeBalance account : It has a $4.95 fee for those older than 24 years. You cannot write paper checks with the safeBalance account but, it also doesn't have any overdraft fees.

· Advantage Plus account: Though the AdvantagePlus account has a monthly fee of $12 for those who are 24 years of age, you can avoid the fee by any of these three methods. You can deposit $250, keep a balance of $1,500 at least, or enroll yourself in a Preferred Rewards Program.

Standouts of Bank of America Checking account

· No monthly fees

· Keep the Change

· Free Bank of America ATMs

· Zelle Payment feature

· Fee exemption option for students who are older than 24 years.

· App available on iOS and Andoid

Drawback: The accounts do not gain any APY on the resting money.

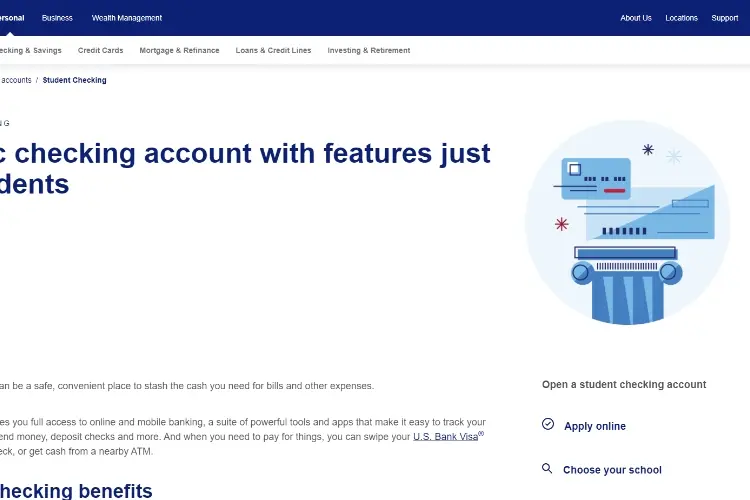

US Bank Student Checking account can be the ultimate right choice for you if you are looking for overdraft options. The account allows you to choose overdraft coverage if you want. There is no monthly fee for the students; neither they charge any ATM fees. But, there is a minimum balance requirement of $25 to open the account. The account does not have any APY, but it provides a Bank Visa Debit card and first checkbook free of cost.

Standouts of the US Bank Student Checking Account

· No monthly fees

· No ATM fees

· Free Debit card and checkbook

· Overdraft option

· Free overdraft for items less than $5

· Free mobile banking app

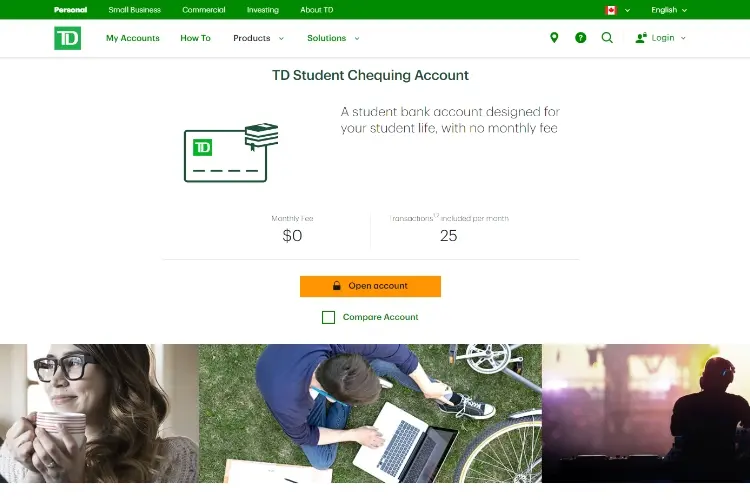

With over 1,250 locations across the Northeast, North and South Carolina, Washington, Florida, and Mid-Atlantic, TD bank offers savings accounts, checking accounts, ATM cards, Credit cards, and much more. If you are a full-time student below 24 years of age, you can open an account without any minimum opening balance condition. The TD savings account offers interest-free overdrafts . Additionally, this account allows free ATM withdrawal from all the TD ATMs in US and Canada and $3 for using a non-TD ATM. It also lets you transfer money to other bank accounts through Zelle .

Highlights of TD Student Checking

· Surplus locations

· No minimum balance

· Free overdraft protection

· Free ATM withdrawals

· Zelle payments

· Online banking facility via iOS and Android.

Drawback: You receive no interest on your money.

The best Student accounts for the US students are now in front of you to select the right one for you. Just pick up the one and get yourself registered today!

About Victor C.

Victor is a highly acclaimed sports writer known for his insightful analysis and captivating storytelling. Born and raised in a small town, he developed a deep passion for sports from an early age. He excelled in both academics and athletics throughout his school years, which laid the foundation for his future career.

|

|

|

|

Yo get FREE Gifts now. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|