by Victor C.

You might be thinking, why do students even need a credit card? It is true that students usually do not have a lot of money in their hands to spend when it comes to expenditures. But that is what makes it very important to spend that money efficiently if you want to save some bucks too. If you do not earn and get little cash on hand, having a credit card can be quite helpful in streamlining your expenses.

As the needs and requirements of students are different than those with a proper earning, you would be glad to know that there are specific card options too. Yes, there are credit cards that give some extra benefits owing to the demands of students!

Contents

· Credit cards also provide additional benefits other than meeting the standard demands of students. Some of the advantages of having a credit card for students include:

· Students can manage their money better

· Helps students to become financially stable

· Allows student loans, apartment rentals, and future mortgages

· Cashback rewards on buying through credit card

Contents

· The facility of buying now and paying later if you are short on cash

· Makes online shopping convenient

· Fraud protection

· Some card allow extended warranties

· Some purchases require card authorization

· Credit cards can help to establish a credit history

Now when you know the need for a credit card for various everyday matters and emergencies, let's tell you the best credit card options for students.

Students are always looking for rewards and discounts as it lets them save a bit of extra money. Discover it Student Chrome credit card is a fantastic such option. This credit card offers rewards along with a good APR. There is a 0% APR for the first 6 months proceeding with the regular rate of 14.49% to 23.49%. Also, you automatically get a 2% cash back on restaurants and gas stations if you spend $1,000 collectively in 3 months. Another great benefit for students is that it exempts you from the annual fees. It means that you do not have to pay any extra charges at the end of the year. Also, there is no fee or APR change on your first late payment.

Discover it Student Chrome offers incentives to students with good grades too. It gives a $20 statement credit on 3.0 GPA or more annually for up to 5 years. Isn't it just like having a bit of more pocket money from your parents on excellent performance?

The card can help you to have that extra layer of security for your credit card. You can also activate the service that sends an alert if your social security number is found on any of the dark web sites.

The Discover it Student Chrome credit card is popular among students as it is easy to get it approved. However, the students of the USA only are eligible for this card.

Get the app for iOS and Android

| Additional benefits for bright students | |

| · No annual fees | |

| · Good cashback | |

| · $20 statement credit for bright students | |

| · Added security | |

| · Easy approval |

You might be wondering that the Discover it Student Chrome card already gives cash backs, so why would you need this card? The answer is simple, Discover it student cashback card gives higher cashback than the student chrome. You can get up to 5% cashback on your purchases quarterly on spending $1,500. But the advantaging categories are rotated every quarter which includes restaurants, grocery, gas stations, and Amazon too! However, the cash backs do not end when you hit your $1,500 limit; rather, you get 1% cashback on all purchases later on. Discover it does not charge any annual fees on any of its student-friendly credit cards to save students from this burden. There is 0% APR for the first 6 months, followed by a variable of 14.49% - 23.49% APR.

How can you avail of the cashback?

To enjoy the quarterly cashback given by the company, you have to activate your bonus rewards at the end of every 3 months.

Get the Discover it® app for iOS and Android.

| Best for high cashbacks | |

| · No annual fees | |

| · 5% rewards | |

| · 1% reward on all purchases | |

| · Bonus rewards | |

| · Less APR |

This card can be the perfect pick for you if you are a regular user of Amazon prime, or if you have wanted to take the subscription. Why? Deserve EDU Mastercard gives you a FREE Amazon Prime Student subscription for one year that is worth $59 annually. This means you save $59 straightaway on getting the card. Isn't it a steal? If you want to avail this fantastic offer, don't forget to select the yearly payment method instead of monthly.

Are you looking for more benefits? You got them here! One of the top benefits provided by Deserve EDU is the cashback . You receive a 1% cash back on every eligible purchase without any limit. You don't only get the cash backs as direct deposits; but, can also redeem it as gift cards, Amazon purchases, statement credits, and a lot more. Deserve EDU is a master card; you get all the Mastercard benefits along with an extended warranty. There is no annual or foreign transaction fee on the card. The Deserve EDU Mastercard can earn you a $30 statement on referring a friend who qualifies for the card. Extra money doesn't hurt, right!

How to get a Deserve EDU Mastercard?

The signing up procedure won't take much time to be explained. It is just as easy as applying for PayPal or Venmo! So, you know what it is going to be like.

Download Deserve for iOS and Android now.

| FREE Amazon Prime | |

| · 1% cashback on all purchases | |

| · Free Amazon Prime Student for one year | |

| · Mastercard benefits | |

| · $30 statement credit bonus | |

| · Extended warranty |

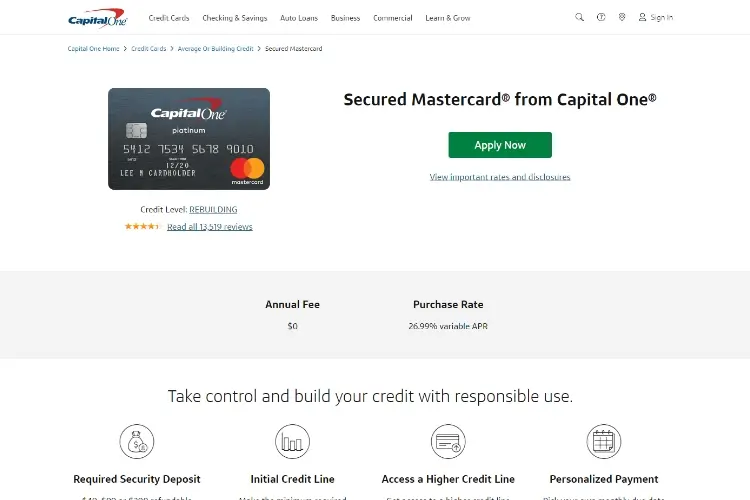

Secured Mastercard® from Capital One®can be an excellent way of instilling some sense of responsibility in youngsters regarding money as it gives you added benefits to being a responsible customer . The Capital One Mastercard requires you to make a cash deposit of as less as $49 up to $99 or $200 to ensure that you are capable of paying your bills. It might seem a hard condition to many of you, but it is for your benefit only. It is a great way to make sure that you would have good money on your card in the hour of need. The added credit can make you eligible for a credit limit of $200 to $1000 , depending on your creditworthiness.

Talking about further advantages, you can increase the credit limit on your Secured Mastercard® from Capital One® without any additional deposit. It is true! Though the card does not give you any cash rewards, you can count it as a reward for being consistent and responsible with your payments. To get the card limit increased, you only have to return the monthly payments for the five months on time, and you are rewarded with a high credit limit on assessment.

Moreover, the Capital One Secured Mastercard has no annual or foreign transaction fees.

Download the Capital One® app at one click.

| High credit limit | |

| · No annual fees | |

| · No transaction fees | |

| · High credit limit | |

| · Upgrading of credit limit | |

| · Low cash deposit needed |

Petal visa credit card is not solely marketed as a student credit card. But it is a good option for beginners who do not have any credit history. Therefore, it is great for students who are just starting to build credit . A prominent feature of the Petal Visa credit card is the high credit card limit of up to $1000. Yes, the credit limit for the Petal Visa Card ranges between $200 and $1000, which is significantly high for any entry-level card.

Another reason to add it in the list of credit cards favorable for students is the absence of annual, transaction, or any late fees with APRs lower than many other beginner-level credit cards. Oh, there's one crucial detail about the card you haven't been told so far! You also get good cashback on a series of timely monthly payments. The card earns you a 1% cashback on all purchases, which can be upgraded to 1.25% after timely payments for 6 months and then 1.5% after 12 months. You can redeem it in the form of a paper check or a statement credit as soon as you have a cashback of $20.

| High credit limit | |

| · Good for beginners | |

| · No annual fees | |

| · No transaction fees | |

| · Upgradable cashback | |

| · Several redeem options |

All of these cards are excellent for students who are just beginning to use a credit card and make a credit history. They all have different benefits which give you a wide variety to choose from. Select your favorite credit card for your student needs and apply right away!

About Victor C.

Victor is a highly acclaimed sports writer known for his insightful analysis and captivating storytelling. Born and raised in a small town, he developed a deep passion for sports from an early age. He excelled in both academics and athletics throughout his school years, which laid the foundation for his future career.

|

|

|

|

Yo get FREE Gifts now. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|