by Victor C.

It doesn't matter if you own a company, or you're working as an individual, who sells a service or goods, credit card processors can be powerful tools for you.

Contents

Back in the time, merchants used to make sales through POS. Point of Sale enabled them to complete a sales transaction. With time, technology flourished, and expensive POS got replaced by credit card processors that work on both, smartphones and tablets.

Credit card processors enable the merchants to use considerably less expensive hardware than POS. However, the software that is used in the processors might or might not cost you money.

One of the most interesting features of these processors is that these processors offer light-weight, small mobile card readers instead of proper and big card-reading terminals. You don't have to get a dedicated, fastest internet connection anymore! This feature has made the life of merchants so easy!

So, if you are in a trading business, working as a merchant, and want to know of the best credit card processing apps to make your business just better than ever, then you are at the right place! In this guide, we will tell you all that you need to know about credit card processors. Read it till the end to get all your questions about credit card processors answered. But before we jump to the list of the best credit card processors, let's talk about some of the important facts that you need to consider before you decide which processor is the best for you.

All credit card processors are not the same! Their features vary. Before you decide which processor to pick, you should consider asking yourself a few questions, such as on what operating system would you like your POS app available on? Would it be helpful to have a virtual terminal as a backup? Would you like to pay for the software every month, or do you prefer the pay-as-you-go option?

Similarly, there is a list of factors and features that should be considered before concluding. But, don't worry! We have got your back! We have listed the top 3 factors of all below, only for you!

Let's begin!

If you are willing to sell services and take payments in person, a standalone POS app is the best option for you!

Whereas, if you aim to expand your business and offer services via various sales channels, an integrated platform should be your priority! It will manage your sales and payments in a much simpler way.

However, if you want to sell online in person, but at the same time, you don't want to miss out on the opportunity of expanding your options later, we suggest you use the integrated platform. It won't charge you for its main features unless you start using them.

There are two types of credit card processing apps available. One type offers a free of cost software, whereas, the other type includes the applications that will offer you a paid software.

Using a free of cost software means that you'd only be charged extra for the payment processing, while, if you use an application that has a paid software, you'd have to pay for both, payment process and software.

Although you can save more money by using the application that offers free software, you should still rethink before going for it, because the paid software will come with a vast variety of features as compared to the free software one. You shouldn't focus on the money you save, but the quality that you'd be keeping up with while you run your errands.

If you have chosen free software, you still need to pay the cost of the hardware. You need a tablet, smartphone, or any other smart gadget to run the software from. Not just that, but depending on your business setup, you might as well need a cash drawer, receipt printer, etc. So, before you make a decision, ask yourself about what collection of hardware should you get to support your business. Think carefully, and spend wisely!

Nobody wants to be a victim of fraud. To make sure that your business stays safe from scam and fraud, you must have a chip card reader. It will cost you extra money, but you will be content.

Now that we have told you about the questions to ask yourself to gain more clarity of what you need, let's talk about the 5 best mobile credit card processing app. We want nothing, but the best for you!

When we talk about the best of all, Square tops the list. Square is a POS application that has it all! There is a vast array of features that is updated now and then. Square offers its features for both, Android and iOS. There are advanced inventory management tools available as well. You can also find a selection of compatible hardware for countertop register setups.

You might still be looking for a feature that makes Square our top pick. Let's tell you that Square is an all-in-one application that offers free invoicing and software features, meanwhile, it also has a premium software upgrade available that you can avail at any moment and enjoy a great package of advanced features.

The Square application is always ready to serve as a centralized control panel of your business.

To give you a better insight, we have mentioned the pros and cons of Square as your credit card processor application.

Pros

· Flat-rate pricing

· Most suitable for low-volume merchants

· No monthly fees or hidden charges

· Extensive array of advanced features

· Affordable chip card readers

· All-in-one payment system

· Free tools for managing sales online

· Available to Canadian merchants

Cons

· Not suitable for high-risk industries

· Account stability issues

Now, let's take a look on how the pricing is set up for each type of transaction:

| Transaction | Pricing |

| Per in-person transaction | 2.75% |

| Per keyed transaction | 3.5% + $0.15 |

| Per invoice or online transaction | 2.9% + $0.30 |

To watch a video tutorial on how to use Square POS app as a pro, click on the link below:

Payline Mobile has made it easier for low-volume merchants to take care of their business. Usually, if a merchant makes a low amount of money per month, he can have only a third-party processor at their disposal. Payline Mobile is breaking all the norms by reaching out to low-volume merchants and giving them a chance to make the most of an amazing credit card processor application for mobile.

Generally, a merchant is bound to make around $10,000 per month to be eligible for using a credit card processor. However, by using Payline Mobiles, you can get yourself unbound to all of such formalities. Payline Mobile only needs you to make at least $1000 per month, and that's it! If you are not earning $1000 per month, you might end up paying a small fee, so make sure that you know the terms and conditions before you make a final decision.

Now, let's take a look at some pros and cons of this software application:

Pros

· Transparent cost-plus pricing

· No early termination fees

· Free virtual terminal

· Free sub-user accounts

· Low monthly fees

· Wide range of features

Cons

· Basic features, not much advanced

The cost and pricing is as the following table shows:

| Monthly fee | $10 |

| Per transaction fee on interchange plus | 0.2% + $0.10 |

Shopify is one of the brands that are always striving for the better! Shopify started as a basic e-commerce provider, but with time, it has gradually enhanced and expanded its platform, converting it into an all-in-one platform for credit card processors. The POS application is available in the market by the name of Shopify POS.

Shopify has expertise in easing the hectic daily-routine formalities that are faced by the merchants. Today, if we look at the marketing sales, Shopify is the most reliable shopping cart. According to the statistics, this company holds more than one million shops worldwide; meanwhile, it has also facilitated more than $135 billion in transactions.

To get yourself familiar with the pricing of this app, view the table below:

Basic Shopify

| Pricing | $29/month |

| Features | Start selling your products online with your secure, beautiful store, and in person at events, fairs, or markets. |

| Credit Card Rates |

|

| Staff Accounts | 2 |

| Shipping Discount | Good |

| Shopify for Retail | Shopify POS for markets and events |

| Rating | Good |

Standard Shopify

| Pricing | $79/month |

| Features | Add features like gift cards, retail hardware support, and professional reports to sell online r at a retail store. |

| Credit Card Rates |

|

| Staff Accounts | 5 |

| Shipping Discount | Better |

| Shopify for Retail | Shopify POS for retail stores and pop-up shops |

| Rating | Most Popular |

Advanced Shopify

| Pricing | $299/month |

| Features | Scale your business online and in person with advanced reporting, and third-party calculated shipping rates. |

| Credit Card Rates |

|

| Staff Accounts | 15 |

| Shipping Discount | Best |

| Shopify for Retail | Shopify POS for retail stores and pop-up shops |

| Rating | Excellent |

Now, let's look at some pros and cons of Shopify POS as well:

Pros

· User-friendly interface

· Various integrations

· Attractive templates

· Advanced design tools

Cons

· Add-ons often necessary

· Variable Customer Support

SumUp is a UK based service provider that makes the in-person shopping, payment processing much easier than most of the processors. SumUp, itself, describes its working style in the following words:

"The first fully-certified EMV mPOS system in the world to cover the entire payment process: card terminals, Android and iOS mobile apps, a payment processing platform and risk and anti-fraud solutions."

Not just that, but SumUp also claims to be the first and only mPOS provider that designs and develops its EMV card terminals.

Now, let's take a look at the pros and cons of this mPOS application:

Pros

· Predictable flat-rate pricing

· Less to no monthly minimums

· PCI compliant solution

· Affordable chip card hardware

· Best for low-volume merchants

· Free of cost, virtual terminal for qualifying businesses

Cons

· Selected features

· Account stability issues

· No in-app invoicing

· Limited reporting

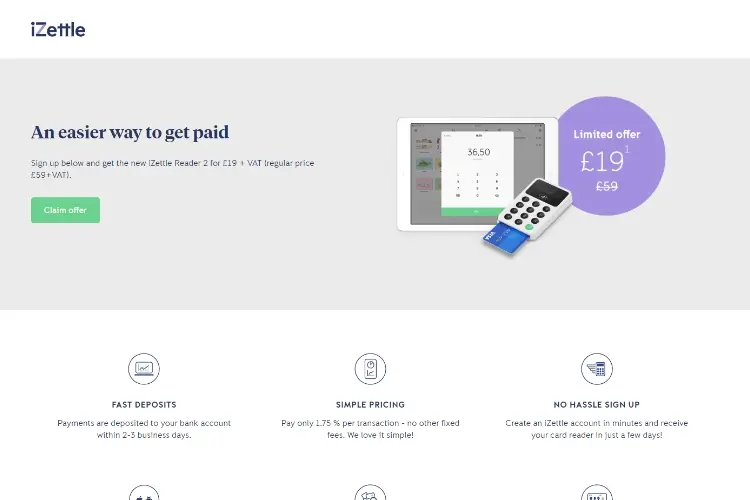

If you are a merchant who is looking for a UK based credit card processor application, iZettle is the best for you! However, it does not serve in Canada or the US at all.

iZettle is often referred to as the Square of Europe. The comparison is valid because iZettle is as amazing as Square. If any downside, it is that it serves region-limited access.

To get a better insight, follow the pros and cons mentioned below:

Pros

· No setup fees

· No application fees

· Free termination

· Predictable flat-rate pricing

· Inexpensive hardware

· PCI-compliant solution

· PayPal payments supported

· Excellent website and advertising

Cons

· Account stability issues

Conclusion

We tried our best to help you out in deciding on getting yourself a reliable and amazing credit card processor, including the general information that you should have as a bonus! If you found this guide helpful, share it with your friends and family.

Thanks!

About Victor C.

Victor is a highly acclaimed sports writer known for his insightful analysis and captivating storytelling. Born and raised in a small town, he developed a deep passion for sports from an early age. He excelled in both academics and athletics throughout his school years, which laid the foundation for his future career.

|

|

|

|

Yo get FREE Gifts now. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|