by Victor C.

Are you a solopreneur with a small business? You want to keep things running but sometimes, keeping the track of every single thing just seems so challenging.

Contents

Getting all the work done, ensuring everything is utilized to its best income and running the whole company all by yourself. It requires lots of energy and patience. Not only that, business requires lots of traveling and, in any case, having a mileage tracker application is an absolute necessity. Such apps keep a check on your travel targets and assist you in saving cash, tax payments, and repayments from contractors and managers. In case you drive an Uber or Lyft, most likely you have realized that it's essential to monitor business associated costs and mileage.

The app is not only for ridesharing drivers. Even if use your vehicle for multiple paid services or any other noble causes, still you are entitled to tax deductions

The purpose of Mileage trackers is not just tracking miles. In a perfect world, they log miles into the friendly-tax plan. Even though whether you do your expenses or contract an expert,you can still use this information to boost your revenue. These applications are important expense associates, taking into account that the IRS allows you the deduction of uncompensated mileage, setting aside some cash on your income tax.

There was a time when following mileage implied dragging the pen across a scratch pad hoping that the pen ink won't run out. And now, as the world has progressed it almost feels like a miracle when you get to know that an app can easily do anything. That counts the tracking app as well.

So, here is a list of our top picks.

Everlance is a nifty application that keeps checking your mileage as well as monitor the entire business expenditures. It is a programmed application that works automatically with the car's movement. Once you start driving, the app starts tracking the miles you cover. You also have the option to label all your work-related or personal trips accordingly, with a single swipe. Work hours can be set consequently, characterizing each trip during that time as excursions for work. It is also another best way to avoid paperwork as it enables you to keep photo receipts and save them the cloud storage. Credit cards or bank account can also be synchronized to it in case one needs it. Not only that, everlance permits you to associate your credit or charge card to the application, at that point, it will assist you with discovering conclusions and produce an IRS-consistent Excel or PDF report for charge purposes.

The app price is around $8 every month and $60 yearly installment, which adds up to $5 monthly. The app's free version offers 30 trips tracking monthly. It is one of the best apps on google play and iTunes. What's more, it accompanies a free seven-day preliminary.

If you want to gather more information about this amazing app, then check this

link.

MileIQ app is suitable for the people that are not frequent drivers like Lyft or Uber ridesharing. MileIQ is a free mileage following application that utilizes GPS-sponsored drive location innovation to naturally log and track miles, and compute the estimation of your drives for duties or repayments. This app tracks about 40 of your rides monthly free of charges. However, the premium package includes infinite ride tracking for only $5.99 monthly. Similar to any other tracking app, this one monitors all the rides you've taken and conveys a far-reaching mileage record available anytime. You can access the information whenever you like. The everyday trip can be grouped into several sorts for example; charity, personal rides or business rides, etc. Every trip can be assigned accordingly to their section with a single swipe or MileIQ can automatically do it for you.

It gives the reports expected to boost your expense conclusions and repayments. MileIQ consequently tracks your miles out of sight so you won't need to physically log your miles or start and quit recording and it will make a consistent mileage log for you. Mileage tracker records all outings down to portions of a mile without expending unreasonable battery power. Mileage reports give data to the IRS and incorporate subtleties your requirement for your operational expense reports. Cost reports are straightforward: Just fare your mileage following information or send yourself a spreadsheet with the information you need. The app is available on google play and iTunes both.

Now, if you want to know how it works? Then feel free to check this

link.

This mileage tracker is an automatic app that monitors your everyday rides by default. The app protects you against any tariff check by keeping a check on both of your business and personal expenses. TripLog similarly gives a complete 100% IRS agreeable detailing which one may utilize utilizing every significant book-keeping stage.

Another important feature of this app is that it's exceptionally adjustable; one can keep a mile log for explicit times or arrange a setup that monitors every personal or business drive. All the business costs like insurance, maintenance, parking, fuel, tolls, etc. are monitored. All these activities may be referring to as business conclusions. The app allows you to save and store all the data in the iCloud. When connected to Bluetooth device or any power source, the app automatically starts tracking the drive if it's above 5 mph. The application underpins companies with truck armadas, traveling workers and vehicle armadas. It is available free on 30 days trial. However, premium features like iCloud backup data storage and automatic monitors only for $4 a month. TripLog is accessible at Google Play and iTunes.

If you are still confused about the app or have further queries, then click on this

link to find out more.

This app is perfect for people who own small businesses. This may include self-regulating out workers, Lyft or Uber drivers, couriers' services, freelancers and independent workers. Hurdlr makes it easy for you to keep data and generate daily expenditure reports. One of its best features it's that, it has joint accounts with PayPal, Square, banks, FreshBooks and Uber so that you can import your expense data and calculate income tax automatically. It has both premium and free versions in which you get access to several features. However, the free version has a limitation as compared to the premium that includes a detailed version of business taxation monitoring. The charges for premium are $7.99 but if you purchase this as a yearly membership for $60, then it separates to $4.99 every month.You can likewise Hurdlr associates with a great many money related organizations, permitting clients to connect their Hurdlr record to their bank or credit association. Hurdlr allows trading of point by point cost reports with receipts and sends them through email or to a professional. Each time you get paid, Hurdlr sends you an ongoing notification. It gives ongoing, annual, and periodical estimations for self-employed entities. Hurdlr is explicitly intended to work without depleting your battery, despite the substance use. You can access Hurdlr on Google Play Store and iTunes.

Check this

link to gather more information about this app.

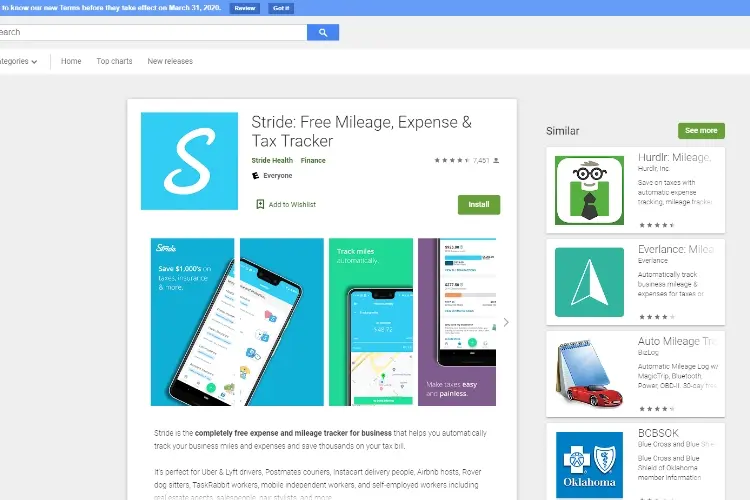

Another free application that works as a background app, discreetly monitoring every ride you take, and afterward, it produces an IRS-prepared report which can be utilized to calculate your tax amounts. It likewise keeps a record of your parking charges, car wash, passenger snacks you offer and rolls. In case you don't know how to identify what costs are detectable, the stride will help you understand using easy means to make sense of it. The application is offered at both the Google Play Store and iTunes.

To figure out how it works? Check the

link for more information.

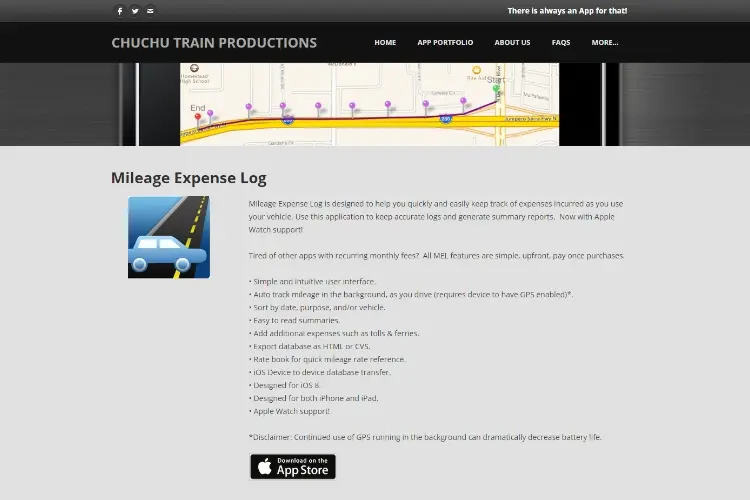

Mileage expense log is a free application is different from any other app for the rate book which is one of its main features. The rate book permits clients to rapidly check mileage charges. For whatever length of time that you keep your telephone's GPS turned on, Mileage Expense Log naturally monitors each ride you take.

In case you're an analyst, you might appreciate the information arrangement by different categories like date, the reason for driving and car even. And last but not the least, the whole data can be sent out to your storage in CVS or HTML format. Mileage Expense Log is just accessible for iOS on iTunes and incorporates support for Apple Watch. This thing makes it somehow limited to Android users.

This was the last pick of our list. There are further good mileage tracking apps available that might not be mentioned in the list but you can always check them out by browsing through the internet. If you find this information helpful then click on the websites and choose which one is best for you. Good luck tracking!

About Victor C.

Victor is a highly acclaimed sports writer known for his insightful analysis and captivating storytelling. Born and raised in a small town, he developed a deep passion for sports from an early age. He excelled in both academics and athletics throughout his school years, which laid the foundation for his future career.

|

|

|

|

Yo get FREE Gifts now. There're other Freebies here

AdBlock now to see them all. Click a button below to refresh

|

|

|

|